2 Letter.com domain names are some of the most valuable properties around. But how much do they go for? Who owns them? How much have they increased in value? All of these answers often depend on who you ask, but now there is enough public data to extract some very interesting information.

2 Letter.com domain names are some of the most valuable properties around. But how much do they go for? Who owns them? How much have they increased in value? All of these answers often depend on who you ask, but now there is enough public data to extract some very interesting information.

When I joined Domain Holdings a couple years ago, one of my main priorities was to educate our clients and the general public on domain names. This is still a very small industry and finding the right opportunity is often a combination of gut instinct, emotional attachment and simply asking for the right price in addition to reported sales. There are very few industries which have the same intangible elements to valuation and one main reason why this industry is entertaining and complex at the same time.

Regarding the numeric or 2 letter .com market, I never really found someone in my almost 20 years experience who follows this unique corner of the market so passionately as one of our brokers: Giuseppe Graziano. Giuseppe compiled an exclusive report and today we want to share it for anyone interested in the data behind 2 letter (LL) .com domain sales and ownership.

Meet Giuseppe Graziano

For those of you who don’t know Giuseppe – well, it is about time you meet him. He is one of our key domain brokers who routinely sells and acquires valuable domains. He recently brokered the sale of a 2 Letter .com, speaks 5 langauages (Italian, English, Spanish, French, Portuguese) and trains daily in Capoeira (a Brazilian martial art).

For those of you who don’t know Giuseppe – well, it is about time you meet him. He is one of our key domain brokers who routinely sells and acquires valuable domains. He recently brokered the sale of a 2 Letter .com, speaks 5 langauages (Italian, English, Spanish, French, Portuguese) and trains daily in Capoeira (a Brazilian martial art).

Giuseppe also publishes a weekly newsletter and regular articles which are quite different than many industry newsletters sharing both his personal experiences along with interesting industry patterns and new domains for sale. Of course, another reason you should sign up for it , is because he includes pictures of Portugal that many of us in the office envy – one more factor that convinced us to make Giuseppe a regular publisher to all our newsletter’s subscribers (we want more photos).

The topics of Giuseppe’s 2 letter .com report include:

- Breakdown of Ownership (China vs World)

- Breakdown of Investor Ownership (China vs World)

- Premium Letters

- Most Popular Letters

- Market Size and Yearly Turnover

- Appraised Value and Keyword Search

- Average End User Sales (10 Years)

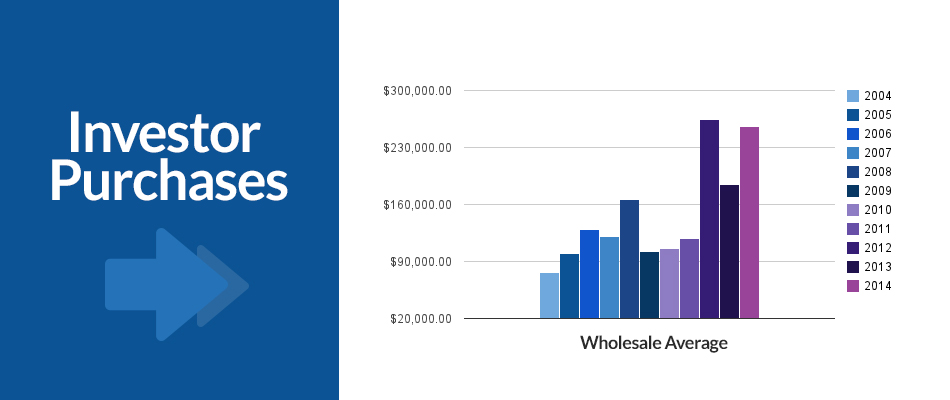

- Average Investor Sales (10 Years)

- and more.

I hope you find the information valuable – if you do one thing today, make sure to sign up for Giuseppe’s newsletter. Here is the report:

By Giuseppe Graziano

1. End Users vs Investor Ownership

1. End Users vs Investor Ownership

Based on our research, end users account for about 63.46% (2/3) of the two letter .com market ownership. Notable owners of more than one LL.com include Google, Pearson Education, CBS, General Electric, General Motors and Yahoo.

Several consulting firms like Deloitte (dc.com), Ernst & Young (ey.com) and Accenture (ac.com) also own a LL.com. Airlines are well represented by American Airlines (aa.com), Singapore Airlines (sq.com), Royal Jordanian (rj.com), Lufthansa (lh.com) and British Airlines (ba.com).

Banks and other financial institution owns several LL.com: Morgan Stanley (ms.com), Bank of Scotland (if.com), Deutsche Bank (db.com), Blackstone (bx.com) and Wells Fargo (wf.com).

Media and Telecom companies are well present: British Telecom (bt.com), France Telecom Spain (ya.com), Telefonica (tu.com), Emirates Integrated (du.com) and RT (rt.com). Tech products are represented by Apple (me.com), the recently acquired mi.com from Mi Xiamo, BqReaders (bq.com).

These are just a few examples. Other industries represented include apparel (UnderArmour – ua.com), tobacco (PhilipMorris.com – pm.com), healthcare (GlaxoSmithKline – sb.com) and others, without forgetting Facebook (fb.com). We can conclude that when brands become truly global and require a certain amount of “gravitas”, purchasing the related LL.com is somewhat a common branding strategy.

2. Chinese Ownership

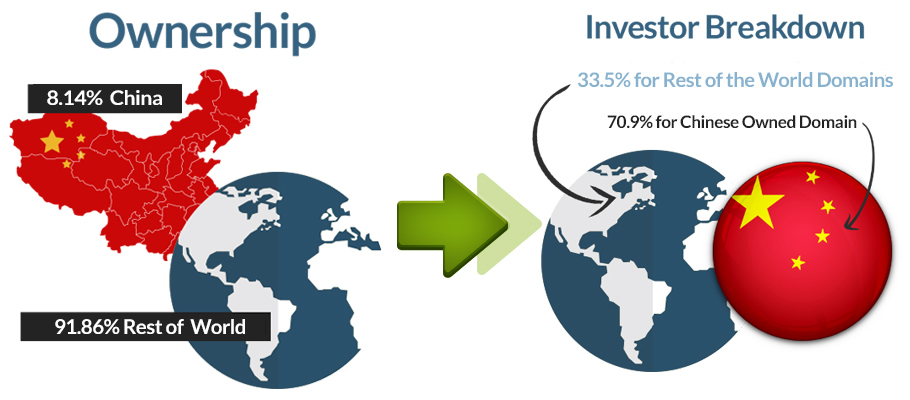

Chinese Ownership accounts for less than 10% of the total market, however, about 71% of these domains are owned by investors. Compared to an average of 33% for investor ownership in the rest of the world, owning a LL.com in China is looked more as an investment rather than a platform to build a business. However, since Chinese investors have lower margins investment strategies, they are considerably active in the aftermarket and, as a result, account for a large part of the yearly market turnover.

From our research, investors from the US pursue more frequently buy and hold strategies, resulting in consolidated ownership of LL.com. Several domain investors like Telepathy, FMA, Mike Gleissner and Alex Lerman own more than 10 LL.com each, accounting for a large part of the market. Other domain investors like Reflex Publishing, Digimedia and some other also own more than 5 LL.com each.

Premium Letters

Premium Letters

3. Most Common and Preferred Letters

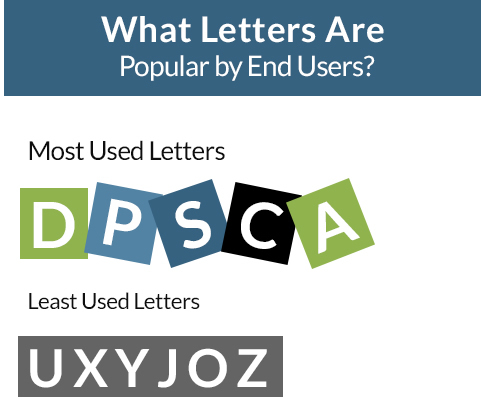

Interestingly enough, the most common letter owned by end users is the letter D, followed shortly by P, S, C and A. Unsurprisingly, the letters the least owned by end users (and therefore mostly owned by investors) are z, o, j, y, x, u, q.

It is also very interesting to note that the preferred starting letter for end users is G, and the preferred ending letter P. The least common starting letter for a domain owned by an end user is O and the least common ending letter is Z.

Values

4. Market Size and Yearly Turnover

The yearly turnover of the market between 2013 and 2014 is 4.14%. This is the number of domain that changed the whois ownership over the last 12 months. Historically the yearly average disclosed transaction has been $478,118, creating a market opportunity of about $13M in potential sales per year. Of course, this is only the tip of the iceberg. Many transactions in this industry (especially larger private sales) are never disclosed and we usually estimate a 20 /80 ratio of disclosed vs undisclosed transactions.

5. Appraised Value and Keyword Search

There is a large difference in Estibot evaluation between the highest appraised LL.com (tv.com – $5.4M) and the lowest (jw.com – $54k) with a staggering difference of 100 to 1. Same goes for the Alexa rank and the number of exact searches for the keyword: while “fb” is searched about 343M times per month, the second one “fa” is only searched 34M. At the bottom we have “zq” with a mere 10k searches.

6. Sale Outlet

Besides for a large part of private sales, the most common ways of selling a LL.com is through brokerage and auctions. The average sale price through auctions is lower than brokerage, although more consistent towards floor market level. Newsletters account for a small percentage of disclosed sales (6.94%).

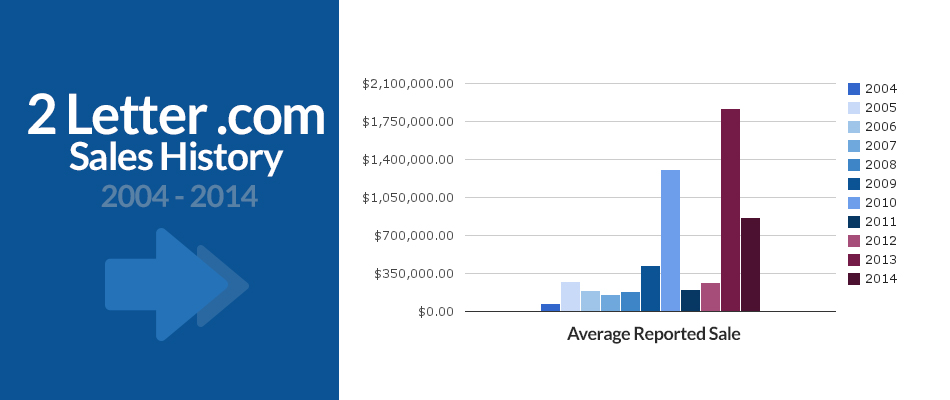

7. Wholesale Prices

The average wholesale price over the last 10 years has been $152,583.66. However, while in the years from 2009 to 2001, the wholesale transactions over $200k have been only 12%, since 2012, the number jumps up to a staggering 81%. This is further proof of how the domain market closely follows the stock market fluctuations and the Nasdaq index, as supported by the IDNX index.

8. End User Prices

The average price of all disclosed transaction over the last 10 years is $478,118. This includes both end users and wholesale transactions. The end user average price is usually hard to estimate because of the many undisclosed transactions, however, if we consider the disclosed recent sales of FB.com, IG.com, MI.com and KK.com, we can comfortably say that it is somewhere in between the low to mid 7 digits.

Back to Alan

How much should you sell a 2 Letter.com domain name for?

This is a question we get asked daily. Giuseppe’s report is quite interesting especially for what concerns the investor ownership in China versus the rest of the world. Once again, the investor market is entirely different from the end user market and, while there is no doubt that investor values are growing, the important factor to consider is the increasing rarity of these domains – especially the continued removal of available 2 Letter .com’s by brands purchasing them. Every time a huge brand like IG.com or Facebook purchases one of the domains, that leaves one less for the investor market. This alone affects value and availability.

In fact, just last night (after this data was compiled) Elliot reported that Andrew Rosener sold CH.com to a Chinese end user leaving one less domain in the investment pool.

How much should you buy a LL.com domain for?

This will depend on the letters, the value, your needs and more. While most agree that a repeating 2 letter combination such as AA.com is more valuable than 2 letters in an awkward order like QX.com – what would happen if your company’s letters were QX? Quite possibly QX.com would be much more valuable to you. It’s impossible to say how much you should pay for a 2 Letter.com due to all the intangible reasons of ownership unique to your company. Our best advice is to look at market data to understand expected ranges and then analyze whether or not the ROI (financially or in brand value) is worth the expenditure to your company. Facebook paying $8.5 million USD for FB.com is likely easily justifiable but for a local flower shop owned by Fred and Betty the same price is probably not.

To recap: If you want a quick sale, you should really be looking at the investor’s market data to find a good pricing range. However, for owners who are patient and either engage a broker or do outreach themselves, the value can be substantially higher.

Want to work with us to acquire or sell a domain name?

Any one of our brokers can help by contacting [email protected] and you can also contact Giuseppe Graziano direct at [email protected]

* All data is based on information obtained from Estibot.com, Domain Tools, DNJournal, Domaining.com, Domain IQ and DomainInvesting.com

Domain Holdings Q4 and Annual Report 2014

/by Alan DunnDomain Holdings is extremely proud to announce our combined Q4 and Annual 2014 report with our Q4 ending strong with $8,086,642 in total domain name sales. Over the last year our team has proven to be a global leader in premium domain name sales representing a wealth of great domains including:

[table “5” not found /]Some of the main highlights from Q4 include:

** Does not include managed auction sales where the buyer was unknown.

Quarter over Quarter Sales

2014 was a very exciting year for us. We ended the year with almost two $10 Million quarters and showed consistent growth every quarter in terms of units. Domain Holdings also ended the year with a much higher quality of exclusive inventory for sale including many owned by corporate clients never listed for sale before.

Average Domain Sale by Quarter

In Q2 we started reporting our Average Domain Sale by discounting the top 5 and bottom 5 sales. As you can see by the chart below we had a very consistent average weekly sales range over the next 3 quarters.

Average Weekly Sales

In 2014 Domain Holdings managed to increased our average weekly sales by well over 100%. We started the year with $263,016 in average weekly sales in Q1 and ended with $622,049 in Q4. The quarters in between were closer to $800,000 per week.

Buyers by Country

The largest 2 markets for Domain Holdings continues to be USA and China. We have seen a continued strong interest in numeric and LL.com domains from the China market during Q4 but also a smaller supply at wholesale prices compared to what was available in Q2 and Q3. What is interesting is the China market interest has expanded greatly to premium .com’s using a wide set of criteria and huge industry end user sales like 360.com (reportedly sold to 360.cn for $17,000,000 from Vodaphone) continue to drive heavy interest from the Chinese market.

What Domains Sell?

.Com’s are still the strongest segment of the domain name market and we really do not expect this number to change much any time soon. However, we do see more GTLD’s selling, premium .CO’s and strong country code domains. In Q4 our sales were comprised of:

Long tail domains or short domains? 77% of our sales in Q4 were 10 characters or less.

2014 Overall was an amazing year for Domain Holdings and we expect 2015 to be even bigger. So far this year we have secured many amazing names under exclusivity including Adopting.com, Give.com, Taiwan.com and the ultra exclusive HongKong.com.

Our predictions for 2015 include:

Overall we are very bullish on 2015 and the future of domain name values in general.

We look forward to sharing this data every quarter and hope to see you this year!

Sincerely,

Managing Director

8.co – Will This Auction Set a Record for 2015?

/by Giuseppe GrazianoIf you have been following the domain market last year, you might recall how the domain sale that took the number 1 spot as the most expensive acquisition of 2015 was Z.com, purchased by the Internet Giant GMO from the Japanese car maker Nissan, for an hefty $6,784,000 (800,000,000 YEN).

The interesting part was that when the news came out, to most of us single letter .com domain names were something unheard of, and not without a reason – there are only 3 single letter .com domain names in the world and it does not look like they are going to be available for sale anytime soon: X.com is owned by eBay and Q.com is owned by CenturyLink.

But, it is with great pleasure that today we would like to announce that one of our trusted partners, Heritage Auctions, is releasing on the market a domain just as a unique that has the potential to take the number one spot for the 2015 domain chart:

We all know that 8 is considered the luckiest number in China. This is because the word for “eight” (八 Pinyin: bā) sounds similar to the word which means “prosper” or “wealth” (發 – short for “發財”, Pinyin: fā). There is also a visual resemblance between two digits, “88”, and 囍, the “shuāng xĭ” (“double joy”), a popular decorative design composed of two stylized characters 喜 (“xĭ” meaning “joy” or “happiness”). The number 8 is viewed as such an auspicious number that even being assigned a number with several eights is considered very lucky.

This belief has caused some curious consequences:

You might say at this point: I get that, but .co does not compare in value to the .com. Well, that is a fair point. The common objection we hear about .co domains, is that, while they are well received and accepted in the start-up community, once the company branding with a .co actually reaches global scale, it necessarily needs to purchase the .com extension to avoid losing traffic to someone else. That usually comes at the cost of an hefty amount, just because it is easy for the seller to understand that they are in front of a motivated buyer.

But 8.co is one of the few exceptions where it is not needed to protect your brand, because 8.com is not available for registration (or purchase) since it has been reserved by IANA. .co is the only short, global, recognizable extension for anyone looking to brand under the number 8:

This is why is not uncommon for big corporations to have secured single letter .co domains for large amounts. Other companies that are proud owners of single letter .co domains are:

Think about having a globally recognized brand with only 3 characters, that can be easily identified in the West while at the same time having the best possible meaning in China. How much more well disposed would be the internet users to join a 8.co network, shopping on a 8.co e-commerce or simply buying services provided by 8.co? How can that affect the revenues, the brand value of your company and your likelihood of raising funds globally?

If you are interested in unique domains or are just thinking about launching the next truly recognizable global brand, we invite you to participate at the 8.co auction. You can access the auction here – the allotted time for internet bids is until Sunday.

Meet Domain Holdings in Las Vegas at NamesCon

/by Alan DunnWhat I love most about this industry is the constant introduction of new words through the power of branding.

In my college years I would have never guessed terms like Facebook, Twitter or Instagram would end up playing such a huge role in our life and yet they have.

Domain names play a critical role in this evolution of global vernacular. The most successful are typically short, brandable, memorable, pass the radio test and more. Some estimate that only 2% of registered domain names really have any value and based on the amount of domains we see it likely is a fair assumption. However it is these 2% which have incredible value and define our past, present and future. While it’s true that money can brand anything it’s also true that it costs a whole lot less with the right name.

NamesCon – The Perfect Brand

Personally, I believe NamesCon deserves a spot on the board of great brand names for 2014 as the term didn’t exist for our industry until (what seemed to be overnight) Richard, Jothan and Jodi branded this only a year ago.

The domain name industry is not just about domains or parking revenue anymore. It’s about naming all together and the NamesCon team has it right. Our industry has been wanting to evolve for years and while the new GTLD’s helped spark everything in motion we also needed a change in conference naming ourselves. We are proud to say we not only support everything NamesCon is doing – but owe them a sincere THANK YOU for taking this leap.

Next week we will be sending 7 members of our Award Winning staff to Las Vegas to meet with customers and talk to new ones. With over 700 people in attendance my best advice is to contact us early and set up a time in advance to discuss working together.

Want to meet our Team at NamesCon?

Contact any of our team members below to reserve a time to talk about buying or selling domains. Over 700 attendees are registered so make sure to schedule something in advance!

Who is Attending?

We are also proud sponsors of The Jenga Game at WaterNight and Women in Domaining so don’t miss out as we will have representation at these events for sure.

Contact any of our team members today. We want to be part of your strategy in 2015 and wish everyone the best of 2015 with safe travels to Las Vegas next week!

Sincerely,

Managing Director

[email protected]

About Domain Holdings

Domain Holdings Group, Inc. (DH) is an industry leading domain name brokerage firm specializing in the representation and acquisition of premium domain names.

Based in Delray Beach, Florida, Domain Holdings Group, Inc. was founded by a group of leading internet marketing experts whose domain industry experience dates back to 1995. The company’s award-winning, distinguished management team retains over 75 years of combined experience working with a multitude of industry-defining organizations including Advertising.com, Mail.com and America Online (AOL).

The Domain Holdings brokerage team has assisted companies globally secure domain names, websites and other digital intellectual property. Clients include many well-known brands including Wikr, Mark Cuban Companies, Match.com, Liberty Tax, Astoria Federal Savings, Envivo Pharmaceuticals, Web.com and more.

The company’s expertise includes all aspects of domain name brokerage and various naming rights such as:

$30 Million – Most Expensive Billboard Ad in Times Square

/by Alan DunnTonight a new billboard will light up in New York City’s Times Square and advertisers will be able to advertise their brand for a reportedly cool $2.5 Million a month. Wow.

Credit to Adweek – Rendering by Neoscape

The billboard will span an entire block—from 45th Street to 46th Street on Broadway – and Google has signed on to have this billboard from now until early next year. (Of course they did).

Times Square is the Super Bowl for billboard ads and with over 300,000 pedestrians daily and the social PR power of the location $2.5 Million seems almost like a deal.

Almost.

Fast forward a few months when the “coolness” of this billboard gets a little old and there is no Kim Kardashian to break the internet or any amazing interactive ads to use this space wisely. There is no doubt billion dollar brands will be buying this space just because they can and we will see some great branding opportunities lost.

Take a domain like Wealth.com (a domain that we exclusively represent). This category killer financial domain could be had for only a few months cost of this billboard. Now, imagine the power combination of branding an amazing ad with an amazing domain. There are very few better combinations in marketing.

As far as brand marketing goes you need 5 core things.

All 5 make an ad the most effective but the destination is going to be your ROI. (Note how it falls before the response). There are so many great commercials I have seen yet still can’t remember what the name of the product was since the ad didn’t have a relevant domain name. When you are spending $2.5 Million a month then it’s probably time to make sure you have all five of these things in order!

Today there are more opportunities than ever before to own category killer domain names like Wealth.com and amazing brandable new generic top level domains like Shop.BlackFriday or Luxury.Vacations

Many brands get the power of domains such as:

You can view a pretty extensive list of category killer domains owned by brands here but there are still many left for acquisition.

So before spending $2.5 Million a month on a billboard my best advice is to read these 10 reasons to upgrade your domain name and then engage the help of a domain name professional who can provide options. After all, if you don’t have the killer brand then odds are you are probably spending a portion of $2.5 million to send traffic to your competition without the benefit of even a holiday card.

Contact Domain Holdings today and learn more about this important piece of your marketing strategy. We help big brands acquire domains every day. The next one could be you.

Domain Holdings Q3 Report 2014

/by Alan DunnDomain Holdings is extremely proud to announce our Q3 sales report showing another quarter with almost $10,000,000 USD in sales. While our top line number was slightly down (-3.8%) the number of transactions were up 7.8% and our largest deal was $2.7 Million versus $5.0 Million in Q2 showing a much healthier overall diversity in sales.

During Q3 we were involved in many key transactions including the sale of BentoBox.com, House.com, Organize.com and more. Highlights from the quarter included:

Buyers by Country

Our Q3 sales saw a huge increase in buyers from the China market including both end users and investors. In Q2 only 9.2% of our sales were conducted with China buyers versus 28.1% in Q3. This is a staggering 300% + increase and re-emphasizes the importance of the China market to the domain industry.

Average Weekly Sales

This weekly average represented a strong summer for sales and continued strengthening of our relationships across key verticals including the start up community, big brands, agencies and the China market.

We also expanded our custom portfolio management in Q3 for large owners of premium domains increasing our available exclusive premium inventory.

Average Domain Sales

In calculating our average sale we removed the top 5 sales and bottom 5 sales to help provide a more accurate overall picture of our performance.

Our average sale increased by 3.15% to $29,932 in Q3 representing a very strong average sale and further verification that the average cost of a premium domain is increasing.

Unit Sales by Dollar Amount

The vast majority of our sales are confidential and this is a trade off we have to make when dealing with larger transactions. However there are certain trends we can show without identifying any specific transactions and/or parties. This quarter we are introducing a month over month chart to make our sales history more visual and also provide some insight into the range of our highest sales.

% of .COM Sales

As noted last quarter the amount of interest in new GTLD’s has been ever increasing but we are still heavily focused on .com sales from a company perspective. This has to do with the with tremendous amount of premium inventory we have under exclusive representation along with corporate relationships where most of the domains owned fall under the .com TLD

One major note is we have seen more offers on new GTLD’s this quarter than ever before and the demand for both premium .com’s and new GTLD’s seems to be increasing. The new GTLD domains are still finding price points primarily due to the short period since their introduction.

We fully expect the ratio of .com sales will stay a significant portion of our business but also decrease slightly as markets move to incorporate the wealth of options available to people as new GTLD’s continue to gain traction and adoption in the aftermarket.

End User Sales

This number is certainly in line with our company objectives and continues to demonstrate our commitment to putting domains in the hands of people who will best use them. Our biggest success factor here is the quarter over quarter increase in buyer requests and referrals. These account for a much larger percentage of our business every quarter reaffirming our committed dedication to client relationships.

How We Do It …

A couple key takeaways can be made from the Q3 activity report however.

(1) We invested in more technology during Q3 improving our data abilities for inventory management and lead generation.

(2) Most of our brokers have been with Domain Holdings for over a year reducing the learning curve for newer hires.

(3) Greater specific buy requests which reduce the amount of targeted outreach to potential end users. There is already a buyer and a specific asset is requested.

Overall, it takes a lot of communication to make a sale. Simply based on the recorded volume of call and emails we averaged 59 calls and at least 480 emails per sale. These numbers are much higher when you include other forms of communication.

The difference in non-recorded events wasn’t deemed significant enough to account for the total activity drop.

Looking Ahead

With back to back quarters of nearly $10 Million each there is no doubt we certainly we have this mark in mind to break in Q4 and the market for premium domains doesn’t seem to be slowing at all. If anything, we continue to see a tightening of what is considered a “premium domain” and much higher values placed on acquiring the perfect domain by end users.

Last quarter we had the following predictions:

Overall our projections were pretty solid for Q3 and over the next few months we expect a continuation of the same projections.

I sincerely hope you enjoy the data we can share. We are extremely proud to be part of such a great industry and look forward to sharing even more data next quarter.

Sincerely,

SVP Sales and Acquisitions

Wealth.com – For Sale Exclusively at Domain Holdings

/by domainholdingsExclusively at Domain Holdings

Delray Beach, FL – October 7, 2014

Domain Holdings Group, Inc., an industry-leading brokerage firm specializing in the representation and acquisition of premium domain names, today announced the super premium domain name Wealth.com is now exclusively for sale by its brokerage team.

“Wealth.com is the ultimate brand for anyone in the financial industry” said Alan Dunn, SVP of Sales And Acquisitions. “In the United States alone there is over $20 Trillion in retirement accounts and wealth is the ultimate goal for almost anyone working today”

The Global Wealth Management Market is estimated to be over $101 Trillion dollars with over 30% of this market in the United States. According to Wealth-X there were almost 200,000 families worldwide in 2013 classified as Ultra High Net Worth Individuals representing over $27 Trillion in cumulative wealth.

The opportunity to own Wealth.com may come with a significant asking price but for many brands this onetime cost is insignificant over the lifetime of a company. “Some companies spend tens of millions of dollars on branding but still never have the brand authority that comes with owning Wealth.com” said Michael McConville, a Senior Premium Domain Broker at Domain Holdings.

Domain names like Wealth.com consistently sell for millions of dollars as online advertising expenditures continue to increase year over year. In 2014 total digital ad sales are expected to top over $135 Billion representing almost a 50% increase since 2010.

Wealth.com is listed exclusively for sale on its own, and has only had one owner since its original registration back in 1994 (20 years ago).

For more information, or if you are interested in Wealth.com, please contact Michael McConville from the Domain Holdings brokerage team at 561-303-1206.

About Domain Holdings

Domain Holdings Group, Inc. (DH) is an industry leading brokerage firm specializing in the representation and acquisition of premium domain names. Based in Delray Beach, Florida, Domain Holdings Group, Inc. was founded by a group of leading internet marketing experts whose domain industry experience dates back to 1996. The company’s award-winning, distinguished management team retains over 75 years of combined experience working with a multitude of industry-defining organizations including Advertising.com, Google and America Online (AOL). The Domain Holdings brokerage team has assisted companies globally secure domain names, websites and other digital intellectual property. Clients include many well-known brands including Wikr, Mark Cuban Companies, Envivo Pharmaceuticals, Web.com and more.

Domain Negotiations 101

/by Giuseppe GrazianoToday is the first day of Autumn and we can definitely feel it arriving in Lisbon, as it has been raining non stop for 2 weeks. In a city with over 3,000 hours of sunshine per year, rain is not always the most welcome sight as the town is not really prepared for it. Anyway, it still feels good to walk around the hills when the clouds break for a moment. Last week I met one of my clients for lunch near the Miradouro of Sao Pedro de Alcantara. Looking over the Castle and the Tagus river, the view from there is simply amazing:

As we sat down and started talking about the status of the domain industry, he said something that really struck me: “Giuseppe, lately I really do not have the patience to reply to people that make lowball offers on my domains. I feel like I constantly have to educate them about why a domain is so valuable, and that adds up to a lot of time”. I looked puzzled and asked him why does he not avoid replying to those emails, as that is a common strategy used by domain owners to filter the serious inquiries. If you own 10k+ domains, you have probably been there as well. You receive price inquiries daily on assets from your portfolio, and you simply do not have the time to price them or give a proper response to all the “student’s projects” or domain brokers.

Not only that, but giving a firm price also locks you in at a number lower than the buyer’s budget. That is why, on the sell side, negotiating successfully the sale of your domains comes down to the approach that described in the book Start with No by Jim Camp. Recommended to me by the great Michael Feeley, it explains how people that seek win-win agreements are regularly taken advantage of by more experienced negotiators that are unwilling to compromise, prepared to be perfectly passive to any requests and stay firm on their bottom line.

I have found this approach very common in large domain portfolio owners. When you have the privilege of working for so long with people that have been incredibly successful in this industry, you start to notice specific patterns. One of them is that they never give a price first, and if you ask them if a domain is for sale, they will often reply with – it is not for sale, but (if you really really want it) feel free to make an offer. Why? Because that saves you time by qualifying the buyers, and allows you to never leave money on the negotiation table. Certainly, you might miss out on a number of smaller deals, but, on the other hand, you will have one or two deals that really matter – those high 6, low 7 digits that make the DnJournal headlines.

Not everybody though can do that. Why? The first reason is simply cash flow. Not anyone has a bank account large enough to withstand months without sales while paying renewals fees. The second reason, is simply, well, guts. How long you can resist giving in on a 6 digits offer is likely what will get you the 7 digits deals. No risk, no reward. That one deal that comes through can change your life – if that comes. Many times it did, especially in the late nineties/early 2000 and that is how the most famous domain investors we know to date came to be.

Again, short, passive answers incredibly help your cause. There is not only money and time that you spend in a negotiation, but there is also emotional expenditure. If you spend one hour writing a long email explaining why your domain is worth 7 digits, it is just human nature to feel more committed to the negotiation, and the other party will notice that. As a result, your negotiating position will be weaker, and that will negatively affect your bottom line. The drawback of the Start with No approach is that it is extremely effective, so effective that you are likely to have always the upper hand in the negotiation, and, when the deal is done, buyer’s remorse settles in and that sometimes comes at the cost of the relationship and the opportunity for future deals.

A Chinese proverb says that at the end of a good negotiation the two parties should leave smiling, as they feel both better off with the deal. As brokers, the goal of every negotiation is to start a relationship, not to end one. That is why the approach I prefer is called principled negotiation and it has been described in the Harvard book “Getting to Yes“; a negotiation classic that was recommended to me by our awesome Mr Joe Uddeme. One of the major takeaway of the book is to always insist on using objective criteria to evaluate what is the fair price on a deal. Other relevant points about the book are to separate the people from the problem, find creative solutions (eg financed deal) and making it easy for the other party to say yes.

But let’s take a concrete example. Let’s say you are the buyer in this case and you are looking to purchase a premium domain. It is a common belief, both in real estate and domain that you make money on the buy, rather than the sell side. So how do you do that? Should you ask for a number first or should you come in right off the bat with a lowball offer? When is it best instead to go directly with a reasonable offer? Well, the answer depends on many factors. The first thing we do when analyzing a domain is to answer a few questions: is the domain brandable or is it a premium generic? Does comparable domains have liquid market value? Has the domain been on the market before and is it likely that the owner is aware of the fair market value?

In negotiation, or marketing for that matter, there is an interesting concept called anchoring, which explains how the final price of a negotiation it typically stays tied to the first number thrown in the negotiation. Anchoring with a lowballoffer works only if you are looking to buy a sub premium or brandable domain that has not many comparables, just like shortblast.com or stormstreet.com (these are just names I made up). In that case, starting with a $500 initial offer rather than asking for pricing, might be an appropriate strategy. Only last week, Tracy Fogarty, shared with us the story of how she saved thousands of dollars to her buyer simply by staying firm and presenting comparable sales to a corporate seller after a buy request.

On the other hand, if you are looking to buy phone.com, coming in with a $5,000 offer will automatically disqualify you. The domain is clearly worth a lot more, and you just look terrible in front of the seller. The relationship is now compromised and that will end up costing you a lot more in the negotiation if that is the domain you really want and you are trying to reestablish communication. The appropriate strategy in the phone.com case would be to ask the owner for an initial pricing and move the negotiation from there, hoping to find a motivated seller.

However, this is likely to work with owners that own less than 100 domains, because, as we said, large domain investors are unlikely to respond with a price to just anybody who asks. How do you get all these information about the domain owners about how many domains they own? Well, this is where domain brokers add value on the buy side. By having the industry experience to understand how much names are worth at wholesale value, we are almost always able to get better deals for the domain you are looking for, usually at no additional costs.

If you are an experienced domain investor with years of industry experience, by all means, I do not recommend working with us if you are only looking to buy one specific name – you can probably do the same job yourself. But on the other hand, if you are just starting out in this industry and are looking to buy the perfect brand for your business, we save you time, we negotiate a better deal, we protect your identity and we can tell you usually within minutes what are the pricing ranges of practically all the major domain resellers in the world.

View more of Giuseppe’s domain stories by signing up for his exclusive newsletter !

Have a fantastic week – from Lisbon!

Giuseppe Graziano

Director of Business Development, Europe

E: [email protected]

M: (+1) 561-819- 8468 (US)

M: (+351) 961-150-279 (PT)

F: 1-954-681-4920

S: ggrgraziano

QQ: ggrg

2 Letter .Com Market Overview

/by Alan DunnWhen I joined Domain Holdings a couple years ago, one of my main priorities was to educate our clients and the general public on domain names. This is still a very small industry and finding the right opportunity is often a combination of gut instinct, emotional attachment and simply asking for the right price in addition to reported sales. There are very few industries which have the same intangible elements to valuation and one main reason why this industry is entertaining and complex at the same time.

Regarding the numeric or 2 letter .com market, I never really found someone in my almost 20 years experience who follows this unique corner of the market so passionately as one of our brokers: Giuseppe Graziano. Giuseppe compiled an exclusive report and today we want to share it for anyone interested in the data behind 2 letter (LL) .com domain sales and ownership.

Meet Giuseppe Graziano

Giuseppe also publishes a weekly newsletter and regular articles which are quite different than many industry newsletters sharing both his personal experiences along with interesting industry patterns and new domains for sale. Of course, another reason you should sign up for it , is because he includes pictures of Portugal that many of us in the office envy – one more factor that convinced us to make Giuseppe a regular publisher to all our newsletter’s subscribers (we want more photos).

The topics of Giuseppe’s 2 letter .com report include:

I hope you find the information valuable – if you do one thing today, make sure to sign up for Giuseppe’s newsletter. Here is the report:

By Giuseppe Graziano

Based on our research, end users account for about 63.46% (2/3) of the two letter .com market ownership. Notable owners of more than one LL.com include Google, Pearson Education, CBS, General Electric, General Motors and Yahoo.

Several consulting firms like Deloitte (dc.com), Ernst & Young (ey.com) and Accenture (ac.com) also own a LL.com. Airlines are well represented by American Airlines (aa.com), Singapore Airlines (sq.com), Royal Jordanian (rj.com), Lufthansa (lh.com) and British Airlines (ba.com).

Banks and other financial institution owns several LL.com: Morgan Stanley (ms.com), Bank of Scotland (if.com), Deutsche Bank (db.com), Blackstone (bx.com) and Wells Fargo (wf.com).

Media and Telecom companies are well present: British Telecom (bt.com), France Telecom Spain (ya.com), Telefonica (tu.com), Emirates Integrated (du.com) and RT (rt.com). Tech products are represented by Apple (me.com), the recently acquired mi.com from Mi Xiamo, BqReaders (bq.com).

These are just a few examples. Other industries represented include apparel (UnderArmour – ua.com), tobacco (PhilipMorris.com – pm.com), healthcare (GlaxoSmithKline – sb.com) and others, without forgetting Facebook (fb.com). We can conclude that when brands become truly global and require a certain amount of “gravitas”, purchasing the related LL.com is somewhat a common branding strategy.

2. Chinese Ownership

Chinese Ownership accounts for less than 10% of the total market, however, about 71% of these domains are owned by investors. Compared to an average of 33% for investor ownership in the rest of the world, owning a LL.com in China is looked more as an investment rather than a platform to build a business. However, since Chinese investors have lower margins investment strategies, they are considerably active in the aftermarket and, as a result, account for a large part of the yearly market turnover.

From our research, investors from the US pursue more frequently buy and hold strategies, resulting in consolidated ownership of LL.com. Several domain investors like Telepathy, FMA, Mike Gleissner and Alex Lerman own more than 10 LL.com each, accounting for a large part of the market. Other domain investors like Reflex Publishing, Digimedia and some other also own more than 5 LL.com each.

3. Most Common and Preferred Letters

Interestingly enough, the most common letter owned by end users is the letter D, followed shortly by P, S, C and A. Unsurprisingly, the letters the least owned by end users (and therefore mostly owned by investors) are z, o, j, y, x, u, q.

It is also very interesting to note that the preferred starting letter for end users is G, and the preferred ending letter P. The least common starting letter for a domain owned by an end user is O and the least common ending letter is Z.

Values

4. Market Size and Yearly Turnover

The yearly turnover of the market between 2013 and 2014 is 4.14%. This is the number of domain that changed the whois ownership over the last 12 months. Historically the yearly average disclosed transaction has been $478,118, creating a market opportunity of about $13M in potential sales per year. Of course, this is only the tip of the iceberg. Many transactions in this industry (especially larger private sales) are never disclosed and we usually estimate a 20 /80 ratio of disclosed vs undisclosed transactions.

5. Appraised Value and Keyword Search

There is a large difference in Estibot evaluation between the highest appraised LL.com (tv.com – $5.4M) and the lowest (jw.com – $54k) with a staggering difference of 100 to 1. Same goes for the Alexa rank and the number of exact searches for the keyword: while “fb” is searched about 343M times per month, the second one “fa” is only searched 34M. At the bottom we have “zq” with a mere 10k searches.

6. Sale Outlet

Besides for a large part of private sales, the most common ways of selling a LL.com is through brokerage and auctions. The average sale price through auctions is lower than brokerage, although more consistent towards floor market level. Newsletters account for a small percentage of disclosed sales (6.94%).

7. Wholesale Prices

The average wholesale price over the last 10 years has been $152,583.66. However, while in the years from 2009 to 2001, the wholesale transactions over $200k have been only 12%, since 2012, the number jumps up to a staggering 81%. This is further proof of how the domain market closely follows the stock market fluctuations and the Nasdaq index, as supported by the IDNX index.

8. End User Prices

The average price of all disclosed transaction over the last 10 years is $478,118. This includes both end users and wholesale transactions. The end user average price is usually hard to estimate because of the many undisclosed transactions, however, if we consider the disclosed recent sales of FB.com, IG.com, MI.com and KK.com, we can comfortably say that it is somewhere in between the low to mid 7 digits.

Back to Alan

How much should you sell a 2 Letter.com domain name for?

This is a question we get asked daily. Giuseppe’s report is quite interesting especially for what concerns the investor ownership in China versus the rest of the world. Once again, the investor market is entirely different from the end user market and, while there is no doubt that investor values are growing, the important factor to consider is the increasing rarity of these domains – especially the continued removal of available 2 Letter .com’s by brands purchasing them. Every time a huge brand like IG.com or Facebook purchases one of the domains, that leaves one less for the investor market. This alone affects value and availability.

In fact, just last night (after this data was compiled) Elliot reported that Andrew Rosener sold CH.com to a Chinese end user leaving one less domain in the investment pool.

How much should you buy a LL.com domain for?

This will depend on the letters, the value, your needs and more. While most agree that a repeating 2 letter combination such as AA.com is more valuable than 2 letters in an awkward order like QX.com – what would happen if your company’s letters were QX? Quite possibly QX.com would be much more valuable to you. It’s impossible to say how much you should pay for a 2 Letter.com due to all the intangible reasons of ownership unique to your company. Our best advice is to look at market data to understand expected ranges and then analyze whether or not the ROI (financially or in brand value) is worth the expenditure to your company. Facebook paying $8.5 million USD for FB.com is likely easily justifiable but for a local flower shop owned by Fred and Betty the same price is probably not.

To recap: If you want a quick sale, you should really be looking at the investor’s market data to find a good pricing range. However, for owners who are patient and either engage a broker or do outreach themselves, the value can be substantially higher.

Want to work with us to acquire or sell a domain name?

Any one of our brokers can help by contacting [email protected] and you can also contact Giuseppe Graziano direct at [email protected]

* All data is based on information obtained from Estibot.com, Domain Tools, DNJournal, Domaining.com, Domain IQ and DomainInvesting.com

Domain Holdings Q2 Report 2014

/by Alan DunnMore End Users

We handled transactions for great brands like PolicyMic, Wickr, Mark Cuban Investments, Liberty Tax and many more with 79.21% of all sales to end users (compared to 76.25% in Q1)

Custom Portfolio Management

Started the rollout of custom portfolio management for large owners of premium domains offering custom landing pages, a dedicated broker, portfolio valuation services, portfolio auction management and more. While this is currently an invite only offering we are open to discussing the program with any premium portfolio owner who is interested in increasing overall sales. View some of our custom for sale landing pages by visiting 95.net, 617.com or designerclothes.com

More Inventory

Signed several exclusive corporate deals to handle existing inventory from of some of the world’s most notable brands.

More Training

Invested thousands of dollars on further sales and negotiation training for our brokers and tools to help refine our outbound sales approach.

While we celebrate our success in this report we should also look beyond the numbers and note that the value of premium domain names are growing due to the combined efforts of the industry and greater public awareness. From the success of the new GTLD’s to the millions of new dollars being invested in promoting existing options there never has been a time with such extensive global marketing finally supporting the industry we love so much.

View the full Q2 report below or download the PDF version here.

The rest of 2014 promises to be an incredible year and I hope you enjoy the data we can share. We are extremely proud to be part of this industry and look forward to reporting even higher sales next quarter.

Sincerely,

$50,000 – A New GTLD Sold

/by Alan DunnWhy is this Important?

All of this translates to more money and interest in the domaining space as a whole. This is not a zero sum game but an expansion of the industry we love so much.

Even the infamous free give away by .XYZ has people talking about these new domains and if you go back a few years ago that is what almost everyone wanted – more press about domains. Whether or not you agree with .XYZ’s approach no one will remember this in five years but they probably will remember the extension.

All in all the negative opinions on these new GTLD’s generally come from a lack of understanding about the cost of marketing, a reactive action to protecting .com or a simple disbelief about domaining in general. The fact is they are here, people are buying and they work. End of story.

Does this mean you should invest in a new GTLD?

Monday morning quarterbacks. Doesn’t everybody love them? There is no right answer for this because it depends on so many variables. 20 years into this industry we are still looking for a valuation tool that has the accuracy of a real estate appraisal so to answer yes or no to such a vague question is impossible.

One company that does deserve an award in this space however is Donuts. By pioneering the EAP pricing model for these new GTLD’s they have created separation between investment and speculation. This is extremely important since any new GTLD needs adoption long term and by adding a higher price value many premiums are in the hands of people who will hopefully use them some day.

What name did we sell for $50,000?

A couple weeks ago we sold Luxury.Estate for $50,000 USD

Personally I think it was a very fair price for the buyer and the seller and for domain investors you should know that this domain was purchased on day 5 of the EAP program roughly costing under $200. That is $49,000 + return on a 60 day investment of less than a couple hundred bucks.

Yes, these new GTLD’s do not work at all 🙂

Don’t get wrapped up in the drama folks. The industry is going to make these a win and when they do – we all win.

It’s not a race, it’s a marathon.