Domain Negotiations 101

Today is the first day of Autumn and we can definitely feel it arriving in Lisbon, as it has been raining non stop for 2 weeks. In a city with over 3,000 hours of sunshine per year, rain is not always the most welcome sight as the town is not really prepared for it. Anyway, it still feels good to walk around the hills when the clouds break for a moment. Last week I met one of my clients for lunch near the Miradouro of Sao Pedro de Alcantara. Looking over the Castle and the Tagus river, the view from there is simply amazing:

As we sat down and started talking about the status of the domain industry, he said something that really struck me: “Giuseppe, lately I really do not have the patience to reply to people that make lowball offers on my domains. I feel like I constantly have to educate them about why a domain is so valuable, and that adds up to a lot of time”. I looked puzzled and asked him why does he not avoid replying to those emails, as that is a common strategy used by domain owners to filter the serious inquiries. If you own 10k+ domains, you have probably been there as well. You receive price inquiries daily on assets from your portfolio, and you simply do not have the time to price them or give a proper response to all the “student’s projects” or domain brokers.

Not only that, but giving a firm price also locks you in at a number lower than the buyer’s budget. That is why, on the sell side, negotiating successfully the sale of your domains comes down to the approach that described in the book Start with No by Jim Camp. Recommended to me by the great Michael Feeley, it explains how people that seek win-win agreements are regularly taken advantage of by more experienced negotiators that are unwilling to compromise, prepared to be perfectly passive to any requests and stay firm on their bottom line.

I have found this approach very common in large domain portfolio owners. When you have the privilege of working for so long with people that have been incredibly successful in this industry, you start to notice specific patterns. One of them is that they never give a price first, and if you ask them if a domain is for sale, they will often reply with – it is not for sale, but (if you really really want it) feel free to make an offer. Why? Because that saves you time by qualifying the buyers, and allows you to never leave money on the negotiation table. Certainly, you might miss out on a number of smaller deals, but, on the other hand, you will have one or two deals that really matter – those high 6, low 7 digits that make the DnJournal headlines.

Not everybody though can do that. Why? The first reason is simply cash flow. Not anyone has a bank account large enough to withstand months without sales while paying renewals fees. The second reason, is simply, well, guts. How long you can resist giving in on a 6 digits offer is likely what will get you the 7 digits deals. No risk, no reward. That one deal that comes through can change your life – if that comes. Many times it did, especially in the late nineties/early 2000 and that is how the most famous domain investors we know to date came to be.

Again, short, passive answers incredibly help your cause. There is not only money and time that you spend in a negotiation, but there is also emotional expenditure. If you spend one hour writing a long email explaining why your domain is worth 7 digits, it is just human nature to feel more committed to the negotiation, and the other party will notice that. As a result, your negotiating position will be weaker, and that will negatively affect your bottom line. The drawback of the Start with No approach is that it is extremely effective, so effective that you are likely to have always the upper hand in the negotiation, and, when the deal is done, buyer’s remorse settles in and that sometimes comes at the cost of the relationship and the opportunity for future deals.

A Chinese proverb says that at the end of a good negotiation the two parties should leave smiling, as they feel both better off with the deal. As brokers, the goal of every negotiation is to start a relationship, not to end one. That is why the approach I prefer is called principled negotiation and it has been described in the Harvard book “Getting to Yes“; a negotiation classic that was recommended to me by our awesome Mr Joe Uddeme. One of the major takeaway of the book is to always insist on using objective criteria to evaluate what is the fair price on a deal. Other relevant points about the book are to separate the people from the problem, find creative solutions (eg financed deal) and making it easy for the other party to say yes.

But let’s take a concrete example. Let’s say you are the buyer in this case and you are looking to purchase a premium domain. It is a common belief, both in real estate and domain that you make money on the buy, rather than the sell side. So how do you do that? Should you ask for a number first or should you come in right off the bat with a lowball offer? When is it best instead to go directly with a reasonable offer? Well, the answer depends on many factors. The first thing we do when analyzing a domain is to answer a few questions: is the domain brandable or is it a premium generic? Does comparable domains have liquid market value? Has the domain been on the market before and is it likely that the owner is aware of the fair market value?

In negotiation, or marketing for that matter, there is an interesting concept called anchoring, which explains how the final price of a negotiation it typically stays tied to the first number thrown in the negotiation. Anchoring with a lowballoffer works only if you are looking to buy a sub premium or brandable domain that has not many comparables, just like shortblast.com or stormstreet.com (these are just names I made up). In that case, starting with a $500 initial offer rather than asking for pricing, might be an appropriate strategy. Only last week, Tracy Fogarty, shared with us the story of how she saved thousands of dollars to her buyer simply by staying firm and presenting comparable sales to a corporate seller after a buy request.

On the other hand, if you are looking to buy phone.com, coming in with a $5,000 offer will automatically disqualify you. The domain is clearly worth a lot more, and you just look terrible in front of the seller. The relationship is now compromised and that will end up costing you a lot more in the negotiation if that is the domain you really want and you are trying to reestablish communication. The appropriate strategy in the phone.com case would be to ask the owner for an initial pricing and move the negotiation from there, hoping to find a motivated seller.

However, this is likely to work with owners that own less than 100 domains, because, as we said, large domain investors are unlikely to respond with a price to just anybody who asks. How do you get all these information about the domain owners about how many domains they own? Well, this is where domain brokers add value on the buy side. By having the industry experience to understand how much names are worth at wholesale value, we are almost always able to get better deals for the domain you are looking for, usually at no additional costs.

If you are an experienced domain investor with years of industry experience, by all means, I do not recommend working with us if you are only looking to buy one specific name – you can probably do the same job yourself. But on the other hand, if you are just starting out in this industry and are looking to buy the perfect brand for your business, we save you time, we negotiate a better deal, we protect your identity and we can tell you usually within minutes what are the pricing ranges of practically all the major domain resellers in the world.

View more of Giuseppe’s domain stories by signing up for his exclusive newsletter !

Have a fantastic week – from Lisbon!

Giuseppe Graziano

Director of Business Development, Europe

E: [email protected]

M: (+1) 561-819- 8468 (US)

M: (+351) 961-150-279 (PT)

F: 1-954-681-4920

S: ggrgraziano

QQ: ggrg

As the summer approaches this side of Europe, last weekend I went to visit one of my mentors in Lourinha, a great beach location in the center of Portugal:

As the summer approaches this side of Europe, last weekend I went to visit one of my mentors in Lourinha, a great beach location in the center of Portugal:

Valencia, Spain. 2 in the morning at the Domaining Europe conference. Discussing about domain values over a few drinks, one of the attendees mentions he owns a 3 letter domain he just bought on auction that he wants to sell for $3,500. I remember saying to myself: wow a three letter .com domain for $3,500 – what a great price. I immediately pulled out my phone and quickly sent an email with the sell request to my team. Unsurprisingly, the domain got sold shortly after.

Valencia, Spain. 2 in the morning at the Domaining Europe conference. Discussing about domain values over a few drinks, one of the attendees mentions he owns a 3 letter domain he just bought on auction that he wants to sell for $3,500. I remember saying to myself: wow a three letter .com domain for $3,500 – what a great price. I immediately pulled out my phone and quickly sent an email with the sell request to my team. Unsurprisingly, the domain got sold shortly after.

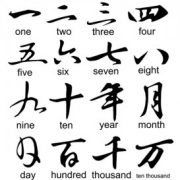

My fascination with numbers in Chinese culture started in front of a newspaper stand in Shanghai. I was about to purchase my first Chinese sim card associated to a phone number and the clerk presented me with a number of options. Oddly enough, I noticed that the numbers had different prices, with the numbers containing more 8s being priced higher.

My fascination with numbers in Chinese culture started in front of a newspaper stand in Shanghai. I was about to purchase my first Chinese sim card associated to a phone number and the clerk presented me with a number of options. Oddly enough, I noticed that the numbers had different prices, with the numbers containing more 8s being priced higher.